Insolvency Market Trends Q1 2021

A view on the market, upcoming trends and highlighted insights

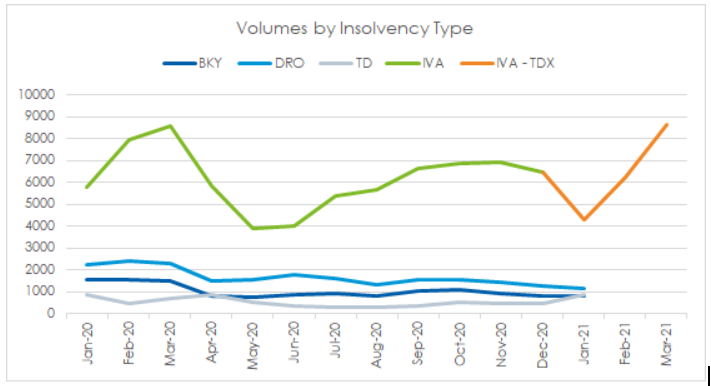

In the Government’s Q1 insolvency release, TDX Group is expecting there to be a reported 6% reduction in individual voluntary arrangement volumes in Q1 2021 compared to the previous quarter and a 15% reduction compared to Q1 2020. The reduction has been mostly driven by very low volumes in January, with February and March seeing volumes more in line with previous quarters.

This time last year, before the pandemic took hold, individual voluntary arrangements and trust deeds were experiencing record volumes with Q1 2020 having the highest number of new personal insolvencies ever. It is no surprise that the volumes in Q1 2021 are lower, especially with the increased financial support provided by the government.

This reduction is also present across other insolvency types in England and Wales, with bankruptcy and debt relief order volumes at the start of Q1 being almost half that compared to 2020. As individual voluntary arrangement volumes returned closer to pre-pandemic levels towards the end of 2020, the number of new bankruptcies and debt relief orders have continued to trend downwards since the pandemic began.

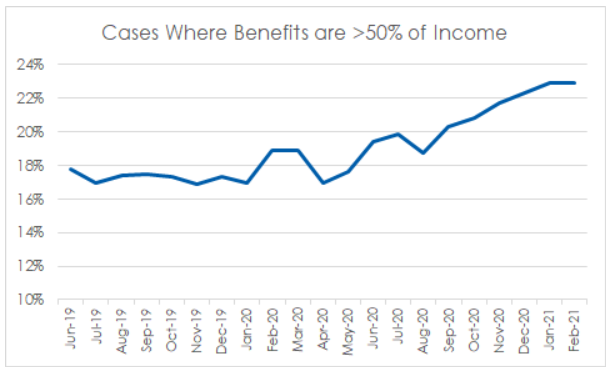

In the 12 months from June 2019 to May 2020, 18% of new individual voluntary arrangements (IVAs) and trust deeds were for consumers where benefits made up over half of their income. Post-May, this average has risen to 21% and is trending upwards, with 23% of IVA consumers in Q1 2021 sourcing over half of their income from benefits. This is the highest monthly percentage since early 2016, demonstrating that more consumers entering into an insolvency arrangement are relying on benefits to pay their monthly contributions.

The increase in reliance on benefits may be due to individuals who are currently employed not requiring an insolvency solution due to the Coronavirus Job Retention Scheme (furlough) and the Self-Employment Income Support Scheme. If this is the case, once government support is withdrawn, pent up demand will be released as consumers who would’ve been in otherwise unsustainable financial circumstances, if not for the support, resort to insolvency.

The impact of forbearance

The impact of furlough and increased creditor forbearance has undoubtedly reduced the demand for debt advice and the update of debt solutions. Whilst both are likely to be high this year, particularly the numbers of those seeking debt advice, it is almost certain they would be much higher had neither furlough, or additional forbearance been in place.

For those already in insolvency solutions such IVAs, a combination of furlough, and the guidance issued by the Insolvency Service - in relation to additional payment holidays for those impacted by Covid (including Covid-related redundancies) - has meant that both variation volumes, and failure volumes, are relatively static.

There are likely to be challenges to these volumes however as the furlough scheme ends, and the temporary guidance expires later this year. Government, creditors, and the insolvency industry will need to work together to mitigate the impact as best as possible, with considerations such as Covid-related early settlements likely to be a discussion point as the year progresses.

Are companies expecting insolvencies to rise?

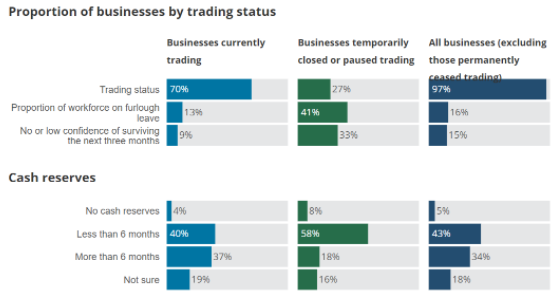

40% of trading companies running on less than six months’ cash reserves (figure 9)

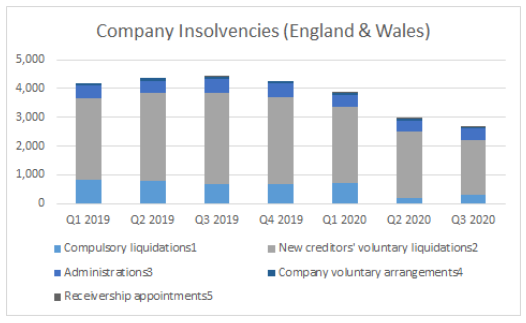

Company insolvencies in September 2020 fell by over one third compared with September 2019 due to reduced operational running of courts and enhanced government support.

Overall numbers of company and individual insolvencies remained low in September 2020, when compared with the same month in the previous year (figure 10). This was likely to be, at least in part, driven by government measures put in place in response to the coronavirus pandemic, including:

- Reduced operational running of the courts and reduced HMRC enforcement activity since UK lockdown was applied on 23 March;

- Temporary restrictions on the use of statutory demands and certain winding-up petitions (leading to company compulsory liquidations) from 27 April. These restrictions were extended to 31 March 2021.

- Enhanced government financial support for companies and individuals

What effect will the Insolvency Service’s guidance on monitoring insolvency practitioners' advertisements, marketing and debt advice have on the sector?

Lead-generation tends to be split into one of two approaches;

FCA authorised debt-packagers

Debt packagers can provide debt advice and 'package' up customer details where an IVA or protected trust deed is the correct solution, to a provider of those solutions.

Lead generators (may or may not be FCA authorised)

Lead generators tend to take more basic details of customers in financial distress, and then pass onto a provider of debt-solutions for debt advice.

There are long-standing concerns about the lead generation market, many of which the guidance calls-out;

- Misleading claims about being 'government-accredited'

- Use of charity/regulatory logos to imply affiliation

- Mis-leading reviews and claims about insolvencies.

There are also concerns that the guidance doesn't directly specify, regarding potential manipulation of income and expenditures to potentially favour certain debt solutions over others. However the enhanced monitoring that would be introduced by insolvency practitioners and regulators should help to identify and remove any such issues.

With regulatory focus now being applied to this area, it will mean that there's an expectation for any insolvency practitioners not already doing so, to monitor and manage any referral partners they have. This could have the impact of leading to some lead-generators, and potentially debt-packagers, leaving the market, similar to what was observed during the regulation of debt management plans.

In theory if this were to happen, and assuming the exiting firms were not meeting standards, it should drive an increase in performance and trust in the sector. It has the potential to lead to small drops in numbers of IVAs and protected trust deeds (known to have one of the highest referral costs), as customers are directed to the best solution for them and not the solution that is desirable for the introducer. However, this would be very difficult to assess with the impacts of Covid, particularly as furlough winds down and the resultant impact that may have on the jobs market.

The focus and approach feels sensible, though it should be acknowledged it is a large undertaking for insolvency regulators, and so any impacts may take some time to filter through.

Are there any key events or regulatory changes on the horizon that could impact the market?

There has been much consultation and review in the insolvency space over the last couple of years. At the end of 2019 there was a consultation about regulation in insolvency, whether there should be a single regulator and, if so, who this should be. To date there has been no output, but it has the potential for significant change in the market, especially if the FCA become involved. Whatever happens, a review of regulatory framework and changes off the back of this, should lead to better outcomes for the consumers and the industry as a whole.

In January of this year there was a debt relief order consultation, that considered whether the entry criteria should be amended to allow more people access. This too has the potential for significant impacts to the debt solution space, with more customers being able to access debt relief orders as opposed to IVAs and debt management plans. This is positive in terms of customer choice/access to solutions, but does have the potential to have unforeseen impacts in other areas such as lending.

Breathing space will be implemented in May, and will see customers working with FCA approved debt advisers able to enter a 60-day period of breathing space. This will provide the customer protection from creditor collections activity for this period, whilst they work with the debt advice firm to put in place a plan to address the customer's debt problems. This should lead to better outcomes and customer journeys, with more people entering the solution that best suits their needs.

The IVA protocol is receiving its first update in around 5 years, whilst many of the changes will have negligible impacts, there is a change for the journey of homeowners that should be for the better. In an IVA homeowners with a certain amount of equity must attempt to remortgage prior to the end of their arrangement, however in the overwhelming majority of cases they are unable to release any funds, often due to a lack of remortgaging options available to customers in insolvency. This means a significant number of people have to go through their IVA under the uncertainty of what may happen to their home, only be be denied equity-release resulting in having to extend their arrangement by 12 months in lieu of equity.

The new protocol puts in place changes (that should hopefully mean only those with a reasonable chance of equity release go down this path) whilst the other homeowners have their property excluded from the outset, with a potential 12 month extension added where they still have significant levels of equity.

This change, once implemented, should mean more customers entering an IVA have more security knowing that their property is excluded from creditors.

The AIB (accountant in bankruptcy) is putting together its own version of a trust deed protocol, as one does not currently exist. Whilst still in its conceptual stage, with a potential release-date of later into the year, introducing consistency and standards into the protected trust deed space can only be a good thing, for consumers and creditors.

There is a new debt solution known as a "statutory debt repayment plan", currently ear-marked for 2022 implementation, though this is not set in stone due to the impacts of Covid making a release data difficult to predict. This new solution will be a more formal version of a current debt management plan as it will require creditors, by law, to freeze interest, charges, and any collections activity. In a debt management plan, this is more 'best practice'. Again, additional choice and more consumer protections should only lead to more positive, and fair outcomes.