By Isobel Crosse, Head of Customer Experience, TDX Group and Andy Sacre, Director of Product, Equifax UK

The growing popularity of BNPL

More than 15 million people in the UK have already used Buy Now Pay Later (BNPL) and the sector is growing fast, already more popular than credit cards with the under 30s. And as new regulations are likely to impact this sector before the end of the year, will BNPL providers be FCA-ready, when it comes to any potential debt recovery?

Whilst the majority of purchases through BNPL tend to be on lower value consumer items, it’s the combination of purchases through multiple credit providers and the overall increase in retail spending which causes the biggest concern for debt industry experts.

Looking at Equifax transaction data acquired through Open Banking, we can see that almost 30% of consumers are making BNPL payments, with an average 5.7 transactions a month for £125 in total.

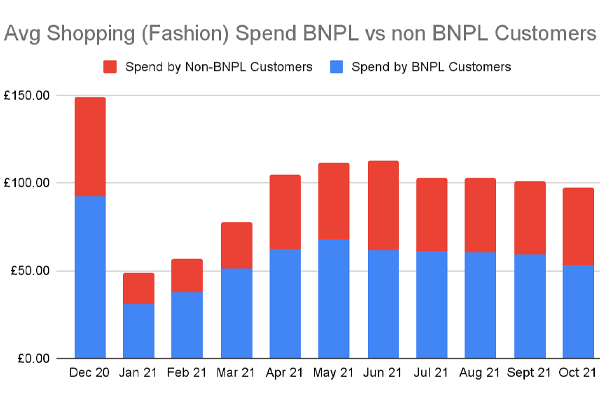

We have been witnessing a general increase in retail spending as a result of the incentive BNPL provides to make purchases seem more affordable. Equifax research shows spending on fashion between Dec 2020 and Oct 2021 was on average 55% higher for a BNPL consumer (compared to a consumer not using BNPL). BNPL consumers also spent 32% more on other discretionary purchases during the same period.

A staggering 76% of UK retailers suggested BNPL will be a key part of their growth plans in 20222. Other industry statistics back up our research, explaining why so many retailers have been jumping on the BNPL bandwagon:

- 57% of merchants using BNPL in the UK reported an increase in basket conversion2

- 46% experienced an increase in average order value2

A recent Equifax survey discovered that 43% of BNPL users reported missing at least one payment which is a worrying indicator for future indebtedness. Statistics like these underline the need to implement FCA regulations into this market.

It must be noted however, that reported default rates so far for BNPL companies have remained relatively low. Market-leading BNPL providers like Klarna and Afterpay suggest default levels could be as low as 1%2.

Who is using BNPL?

One of the main reasons behind the FCA’s decision to regulate BNPL was to ensure we can better protect vulnerable customers. Therefore, knowing who is using BNPL is key. Equifax research showed the majority of BNPL users were under 35 (56%) and 39% of consumers in the 20-25 age bracket had used BNPL3.

This is important because younger age groups are more likely to have a thin credit file. In Australia we found that consumers who use BNPL regularly tend to have lower credit scores and are more likely to fall behind on their other credit products.

Fortunately for consumers, BNPL credit providers like Klarna do not apply any late fees and would usually prevent consumers from taking out any further credit from them should they fall into a default situation. But as other lenders (including BNPL providers) don’t have any visibility of recent buy-now, pay-later credit arrangements, it’s all too easy for someone struggling to repay a loan to get even deeper into debt by applying for additional credit from other BNPL providers.

Right now, BNPL providers are not yet required to provide a data feed into credit reference agencies like Equifax. So unless a lender is using a service like Open Banking in their assessment of affordability, they will not yet have full visibility of an individual's credit commitments (including BNPL payments). According to a 2021 survey from BNPL lender LayBuy, “71% of respondents agreed that sharing the information on use of BNPL products with other credit companies is necessary”.1

It’s important to note that most BNPL credit providers will also use Debt Collection Agencies to recover any payments which remain unpaid.

The impact of BNPL on credit scores

The unsecured lending market wants increased transparency and is calling for BNPL data to be incorporated into credit files so there are no hidden debts, allowing them to make smart, informed decisions when lending, ensuring they have a holistic view of a customer’s financial commitments. Many Equifax clients are also offering BNPL products themselves and want to use data to make better products and deliver robust yet smooth affordability checks.

At the moment, some BNPL providers use soft searches to assess customers, however, they don’t need to apply the same level of credit and affordability checks as other lenders operating under FCA regulations. Consumers are backing the move to a more regulated approach, according to research from BNPL provider LayBuy, “81% of BNPL consumers agreed that credit checks on financial history should be carried out before a customer can access the product “.1

In the US, we found adding on-time BNPL payments to credit files boosted consumers’ credit scores, especially if they had a thin credit file. It will also protect customers who use BNPL from overindebtedness.

Plans to help all lenders make better decisions

Equifax will start to add BNPL to credit files as soon as summer 2022. This will benefit customers who use BNPL and pay their bills on time, whilst increasing fairness and transparency for customers and businesses alike. Equifax will also further develop fair and accurate credit scores and characteristics for creditors that includes BNPL data.

At the same time we will continue to develop products like our Open Banking services and fraud capabilities for our BNPL clients to help them grow their business, give consumers a great experience and get ready for the requirements of FCA regulation.

Ultimately, this is all about fairness and transparency for customers and for businesses. The benefits to customers are that it will help boost the financial profiles of those typically associated with thin file and reward those using BNPL well. Businesses will have a better, more holistic view of the circumstances in which they are making a lending decision - being able to see a customer’s full financial commitments and not having to worry about hidden debt.

The regulatory impact on BNPL lenders

We expect FCA regulation of BNPL to begin in late 2022 or early 2023. While the exact rules are still to be finalised, the FCA will expect BNPL providers to meet high standards for creditworthiness assessments, treating vulnerable consumers fairly and fair debt collection.

It’s likely that providers of BNPL services will be required to implement some level of affordability checks, but we expect the response to be proportionate, based on the low-value of most BNPL credit agreements. It’s unlikely BNPL lending will require the same level of affordability assessment as a £10,000 car loan or a mortgage application for instance.

The fair treatment of consumers in arrears is at the heart of FCA regulations. BNPL companies will need to ensure they treat consumers who default with appropriate care. This means identifying potentially vulnerable consumers and choosing the right treatment path based on individual circumstances.

The extent of the new Consumer Duty being proposed by the FCA is yet to be fully realised, but we expect this new guidance ( to be confirmed by 31 July and implemented in 2023) to add even greater pressure for all lenders to deliver good outcomes for retail customers.

How TDX Group can help

As part of the Equifax group, we believe BNPL firms should prepare to put in place the right processes to ensure readiness for the regulatory changes to come. Only Equifax has the credit data, Open Banking and debt collection expertise to help BNPL providers with every stage of that journey.

As the UK’s leading provider of data-powered debt collection and recovery services, TDX Group can provide the debt expertise to help BNPL credit providers prepare for the additional requirements which come hand-in-hand with FCA regulation.

It’s our fundamental belief that the recovery of debt could be infinitely more efficient, effective and fair through the use of more data and analysis. We provide debt advisory services to a number of clients to help them to operate within FCA regulations, as well as offering unique specialisms in vulnerability, digital collections and Open Banking to help our clients choose the right treatment path for every customer, based on individual circumstances.

Contact us to find out more about our Debt Advisory services and how we can help BNPL credit providers become FCA-ready.

1Source: LayBuy research featured in AltFi article

2Source: Bain Buy Now Pay Later in the UK report - Oct 2021

3Source: Equifax transaction data research between Dec 2020 and Oct 2021